The Sport Investment Studio is an investment and advisory platform dedicated to transactions at the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

Welcome to another edition of our newsletter on sports investment. This week, we talk about the NFL’s stake in ESPN, a major merger in US women’s volleyball, and much more!

We hope this newsletter gives you some useful background, insights and ideas on sports investments trends that we identify and focus on.

Don’t hesitate to reach out to us for more, or to share your comments.

The NFL has taken a 10% stake in ESPN, valued between $2.5-3 billion.

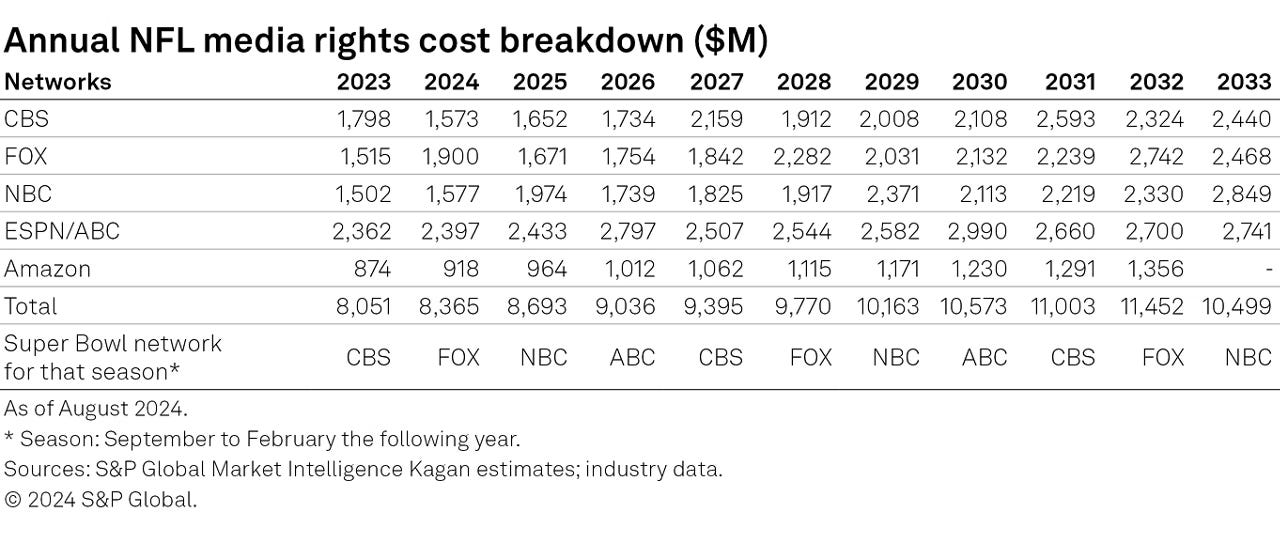

The National Football League will become a minority owner of ESPN after striking an agreement that gives it a 10 percent equity position in the Disney-controlled sports network. Analysts value the holding at roughly $2.5-3 billion. In exchange, ESPN will take over NFL Network, the popular RedZone channel and the league’s fantasy-football platform, expanding its football inventory just as the company prepares to launch a stand-alone ESPN streaming service later this year. The NFL will keep control of NFL Films, NFL+, and other digital properties.

Financially, the league gains two income streams. It should receive future dividends tied to ESPN’s profits and stands to capture equity upside if the new ESPN direct-to-consumer service meets growth targets. Analysts calculate that every five million streaming subscribers could lift the value of the NFL’s stake by several hundred million dollars.

ESPN chairman Jimmy Pitaro said the added content will “supercharge” the forthcoming direct-to-consumer offering, while Commissioner Roger Goodell projected greater international reach and new technology for fans. Industry observers noted that an equity stake lets the league share directly in future media upside while retaining bargaining flexibility with other broadcast partners, a structure rarely seen in U.S. sports. Regulators are expected to give the agreement a close look. Antitrust lawyers say the Department of Justice will scrutinize whether combining NFL Network and ESPN under Disney reduces competition in sports media or forces rivals to pay higher carriage fees.

Read and more:

More on the deal. (WSJ)

The deal is subject to regulatory approval, and that may not be smooth sailing. (Reuters)

The deal might also bring relevance to ESPN’s new $29.99 streaming service, and improve their OTT prospects. (MarketWatch)

A big merger hits American volleyball

The United States will see its women’s indoor volleyball landscape streamlined after Pro Volleyball Federation joined forces with the still-to-launch Major League Volleyball to create a single competition that will operate under the Major League Volleyball banner. The leagues announced the deal on 5 August, confirming a reported combined valuation of roughly $325 million, according to Sportico and Front Office Sports.

Pro Volleyball Federation, which has completed two seasons, brings existing clubs and game operations. Major League Volleyball contributes capital and the brand it had been developing ahead of an intended 2026 debut. The unified circuit will open play in January 2026 with eight franchises: Atlanta, Columbus, Dallas, Grand Rapids, Indianapolis, Omaha, Orlando and San Diego.

The consolidation answers concerns that the U.S. market was becoming crowded. After the deal there will still be three national women’s indoor circuits: the new MLV, League One Volleyball and Athletes Unlimited’s Pro Volleyball Championship, each occupying different calendar windows. Executives argued that a stronger single entity should attract larger broadcast partners, better sponsorships and higher player salaries.

League officials said Pro Volleyball Federation secured about $40 million in fresh funding to support the merger. BofA Securities served as exclusive financial adviser. Among the headline investors are Orlando Magic owner Dan DeVos, backing the Grand Rapids Rise, and Sacramento Kings owner Vivek Ranadivé, who leads the Northern California expansion franchise.

Read more:

A primer on the leagues and their merger. (Front Office Sports)

More on how the combined league will work on the court. (PVF)

Information on the meteoric rise of the PVF, and the valuations within it. (Sports Business Journal)

Oregon’s State Treasury will invest pension funds in sport.

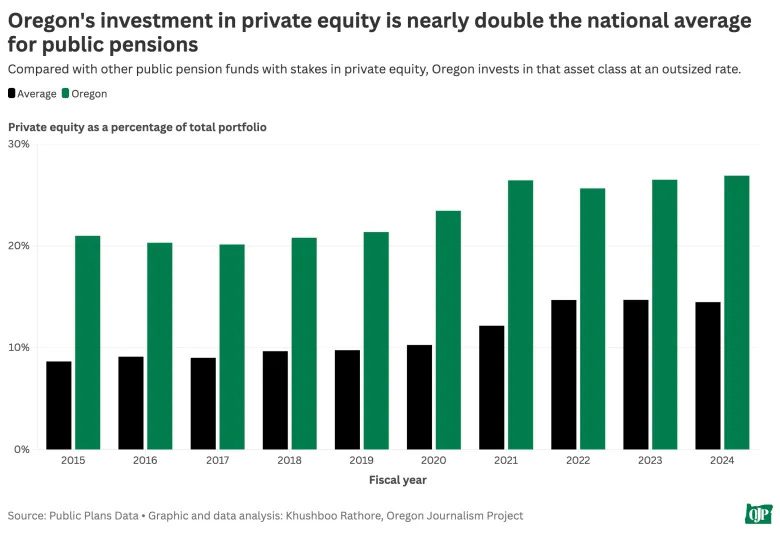

Oregon’s $144 billion Public Employees Retirement Fund is steering a slice of its capital into professional sports, a move spearheaded by the state treasury’s $2.9 billion “Opportunity Portfolio.” The model is unique as it represents a vastly different form of public investment in sport.

The portfolio holds indirect minority stakes in the Buffalo Bills, Golden State Warriors, San Antonio Spurs, Los Angeles Dodgers, Chelsea FC and Paris Saint-Germain through commitments to Arctos Sports Partners, Sixth Street and Clearlake. A $150 million follow-on investment in Arctos’s $4.1 billion second fund in 2023 expanded that exposure, and staff are now studying emerging opportunities in the National Women’s Soccer League and the WNBA. Treasurer Elizabeth Steiner’s team frames franchises as scarce, cash-generative assets whose live-rights pricing power is insulated from broader market cycles. Internal research cited by Oregon pegs long-run franchise appreciation at about 13 percent annually

Current exposure is below 0.3 percent of total pension assets and liquidity constraints, but could rise if the fund manages to find lucrative opportunities elsewhere.

Read more:

More on the fund’s plans. (Markets Group)

Other pieces of news that interested us:

We finally have viewership figures for MLS’ deal with Apple TV; each game on the platform averages around 120,000 viewers. League commissioner Don Garber has admitted that revenue figures on the platform haven’t gone through the roof yet, but remains a staunch believer of the model. (SportsPro)

Boston Celtics minority owner Steve Pagliuca has acquired the WNBA’s Connecticut Sun for $325 million. An additional $100 million investment will be put towards a dedicated practice facility, with further plans to relocate the franchise to Boston. (Cosmos Sports)

After a tumultuous summer, John Textor is reportedly looking to join forces with Nottingham Forest & Olympiakos owner Evangelos Marinakis for his next multi-club ownership endeavour. Under this arrangement, Marinakis would help Textor purchase Botafogo and RWDM back from Eagle Football Holdings, which is likely to end up in the hands of its creditors. (The Athletic)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com