The Sport Investment Studio is an investment and advisory platform dedicated to transactions at the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

Welcome to another edition of our newsletter on sports investment. This week, we talk about how new formats and alternative leagues are changing the dynamics of many of the world’s major sports, including football, golf, cricket and volleyball.

We hope this newsletter gives you some useful background, insights and ideas on sports investments trends that we identify and focus on.

Don’t hesitate to reach out to us for more, or to share your comments

What’s going on?

Shorter and more entertainment focussed formats are coming up in nearly all major sports, thus threatening the existing status quo. These formats claim to be built for the new generation of sports fans, who according to research, have attention spans of just eight seconds, yet remain committed to watching sport as much as their older counterparts. Gen-Z fans still spend an average of 3 hours 36 minutes a week watching sport, however their consumption habits are quite different. 10% of Gen Z fans only watch highlights, and the bulk of their viewing takes place on OTT platforms.

Thus, a new generation of alternative sports leagues are building for this exact crowd. Some of the most notable such formats/competitions are:

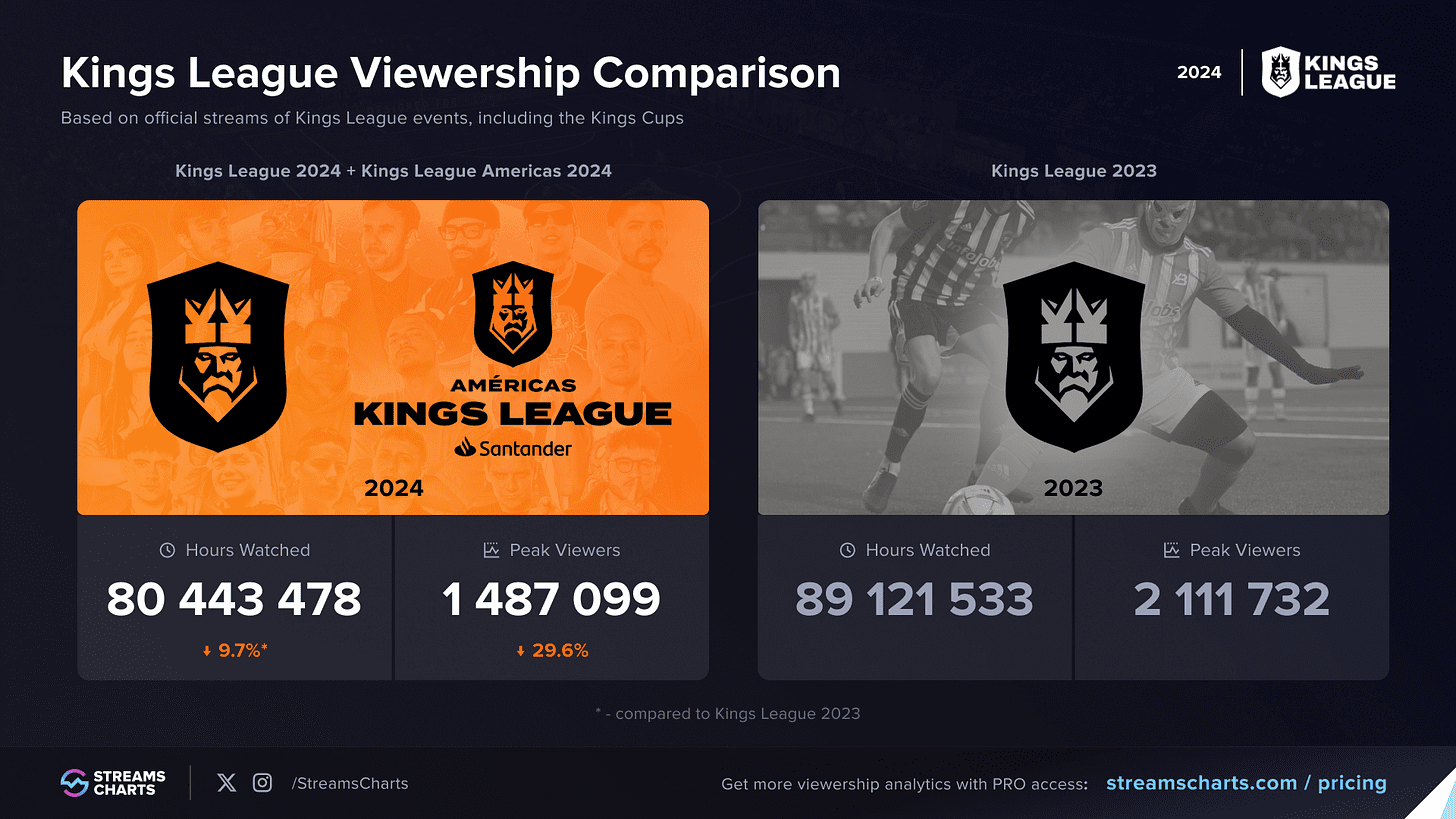

Baller League/Kings League (football): Short form football leagues with 6/7 players a side, 30 minute matches, and a set of gamified rules that add additional jeopardy to each game. Both leagues are driven by streamer, creators and current or former athletes, who double up as players and owners. Kings League, founded by Gerard Pique, €20M in 2023, peaked at concurrent 800k viewers, and hits markets across Europe and Latin America. Baller League drew 71k+ Twitch peak viewers day‑one, boasts a million social followers, and raised $25m to expand into the UK/US.

The Hundred/T10 (cricket): The Hundred squeezes each innings into 100 balls instead of T20’s 120, pairs men’s and women’s games in the same slot, and has already sold £520m of equity that pegs its eight city franchises at about £975m. The league’s 2024 men’s final peaked at 1.3 million BBC viewers and seasons shift roughly half-a-million tickets. Concurrently, upstart leagues in the Middle East, such as the Abu Dhabi T10 are creating even shorter, 10-over, 90-minute games. The league pulled 342 million global viewers in 2024.

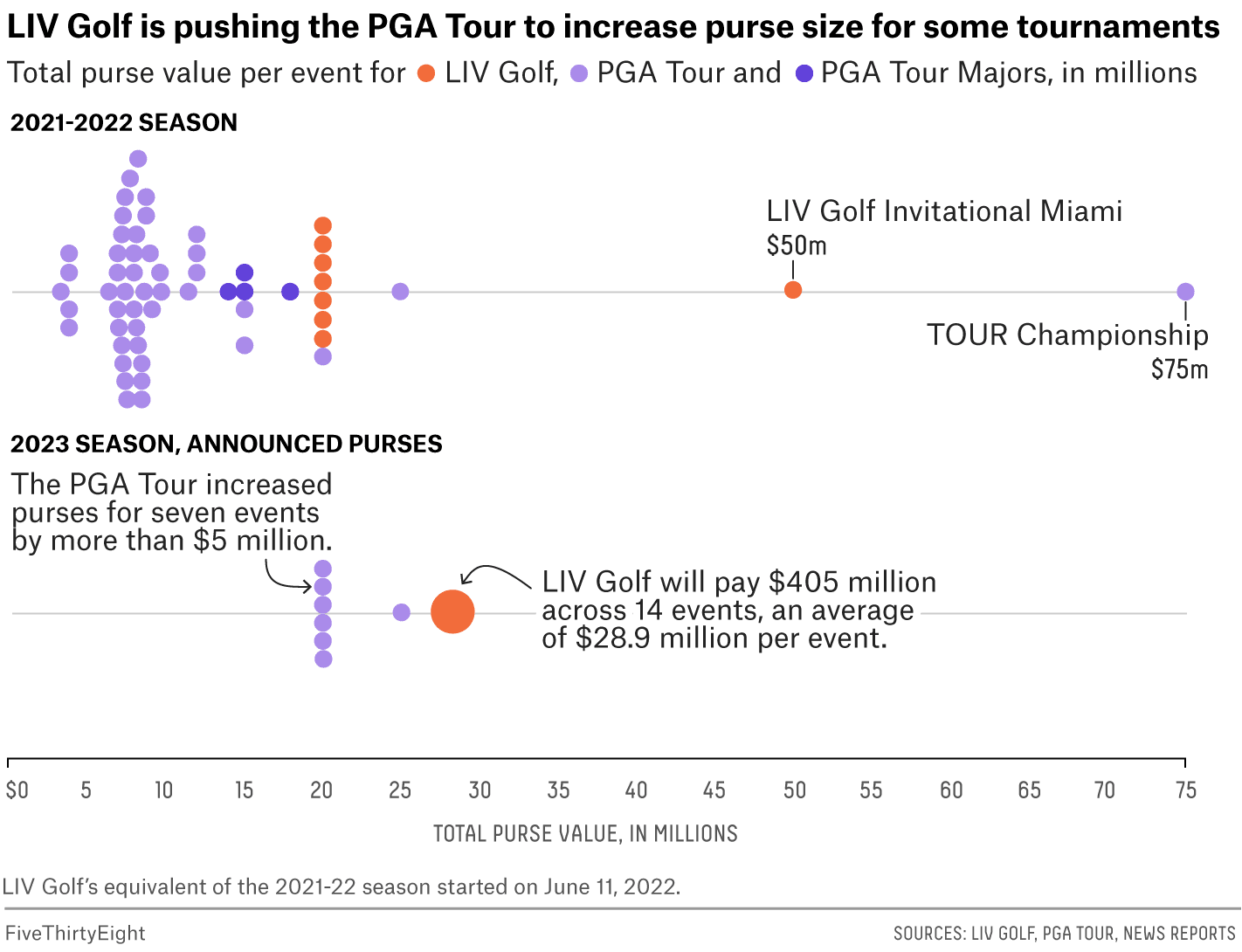

LIV Golf/TGL (golf): LIV Golf is the 54-hole, team-scored tour bankrolled by Saudi Arabia’s Public Investment Fund, which has poured almost US $5 billion into the project. On the other hand, a star-studded lineup including Tiger Woods, Rory McIlroy, FSG, and David Blitzer is pushing TGL. The league re-imagines golf as a two-hour arena show with a shot clock and six city-based teams of PGA stars. Valued at ≈US $500 million before a single swing, its ESPN debut averaged 919k and peaked at 1.1 million viewers.

LOVB (volleyball): A new U.S. women’s indoor league that debuted in January 2025 with six city-based teams. It layers a 66-club, 16 000-athlete youth system under the same brand, creating a full “club-to-pro” pathway. Investors Atwater Capital, Ares and Left Lane have pumped US $160 million into the project, and ESPN carries 28 matches nationwide.

What makes these leagues special?

At their core, these formats and others like them promise a more compact, fast paced and entertaining version of the sport they represent. However, there are a number of other key commonalities among these leagues.

Focus on casuals: Believing that Gen Z has reduced attention spans which make traditional sports too long for them, these leagues are creating hyper-stimulating, short-form formats. Abu Dhabi T10 wraps an entire cricket match into 90 minutes, while Kings League’s influencer-owned 7-a-side games last 40 minutes yet still draw 24.8 million hours watched. Gamified twists like power-ups, and live fan polls keep the action interactive. Many key characters in these leagues are also streamers, actors and other entertainers that may not have their roots in sport. Thus, these formats often serve as congregation points for streamer audiences, as opposed to outright sporting events.

Creative broadcast modes: These leagues are creative in both how and where they show their product. For example, TGL’s arena uses a giant simulator, movable greens, hot-mics and a 40-second shot-clock, providing an experience that has been yet unseen in golf. Baller League UK secured traditional broadcast deals with Sky, while also showcasing itself on Twitch and YouTube worldwide, thus giving it unparalleled reach. The broadcast experience for most traditional sports leagues has remained functionally and visibly similar for around two decades now, while restrictive rights deals often arrest the potential leagues hold to display their own highlights and games.

Heavy private money from day one: Saudi PIF has injected almost $5bn into LIV, The Hundred’s equity sale values its eight teams £1.2 bn, LOVB has banked $160m pre-kick-off, and both Baller and Kings League have secured private equity investments. This capital allows them to expand and innovate on their product with lots of operational freedom, which is something that legacy sports properties envy.

Built-in inclusivity: The focus on young audiences, as well as the lack of administrative red tape and historical baggage makes it easier for these formats to be inclusive. In The Hundred for example, women’s and men’s fixtures are scheduled back-to-back, while the Kings League’s sister competition, Queens League, is treated as an integral part of the same ecosystem. Combine this with accessible and youth driven marketing, and you get a situation where the next generation of female players see these leagues as their primary reference point for sport.

Due to a level of capital that was previously unheard of in golf, LIV Golf changed the finances of the entire sport, leading to a mass exodus of players from the PGA Tour and an increase in prize money across the board. (538)

What comes next?

The key question here is: will these formats pose an existential threat to existing hierarchies in sport, or will they simply serve as appendages to them? The answer depends on things such as the sport in question, the amount of money that these leagues have at their disposal, and also on whether they can sustain themselves in the long run. However, we can identify some key trends:

Coexistence over domination: Golf is already showing the path here. The PGA Tour has spun off the $3 billion for-profit PGA Tour Enterprises and continues to haggle over a separate Saudi PIF investment that would keep LIV’s team events on the calendar. LIV, for its part, is cementing leverage by adding first-time stops in South Korea, Hong Kong and Indiana for 2025. A blended “world tour” that shares players and broadcast windows now looks more plausible than outright domination of one particular tour.

Co-opting and collaborating with new formats: Traditional football brands are beginning to treat Kings League as a opportunity, not a threat. Olympique de Marseille has lent colours and content support to Wolf Pack FC in Kings League France, while Juventus has aligned with Zebras FC for the Italian edition. With Kings League World Cups landing in Paris and Brazil, and Baller League rolling out in the UK and eyeing the U.S., such partnerships will only multiply.

Filling the gap in the calendar: Sports that leave long off-seasons are spawning parallel circuits rather than losing eyeballs to Netflix. Ice Cube’s BIG3 basketball league occupies NBA arenas every July–August, while LOVB’s Omaha Supernovas average ≈11,000 fans and Spurs Sports & Entertainment just bought into a new Austin team in the league. Arena owners now see these properties as revenue bridges, and athletes gain year-round earning options.

Short-form leagues as R&D labs: Cricket boards too, are co-opting shorter leagues and testing new innovations in them. The Hundred gives local cricket clubs a cash lifeline while leaving other formats untouched, and it will trial crowd-mic’d time-outs and dynamic graphics that could become mainstream. Meanwhile, at least two ICC full members are lobbying for T10 to receive official status, positioning the 90-minute format as an Olympic-ready pilot. Expect federations to license or co-own these new products to court casual fans and try out new ideas, across sports.

📰 Read more:

A critical take on Baller League, in particular its UK expansion. (Jordan Wise on Substack)

The FT’s piece on how digital platforms are facilitating the rise of leagues such as Kings League and Baller League. (Financial Times)

A look into the experience that Baller League offers, and how that’s catching the eye of traditional footballing entities. (Reuters)

ESPN’s overview on The Hundred, and the near-billion pound valuation that its teams have raised this year. (ESPN)

Despite nearly $5bn in investment from the Saudi PIF, LIV Golf is rapidly losing money, which puts its future in doubt. (Reuters)

An explainer on the TGL. (SportsPro)

Sports Business Journal’s primer on LOVB and how it is changing volleyball. (SBJ)

Other pieces of news that interested us:

Kevin Durant’s Boardroom has signed a partnership with the Qatar Sports Investments. As part of the deal, Durant will become a minority shareholder in Paris Saint-Germain. (QSI)

The Buss family, which has owned the Los Angeles Lakers since 1979, is now selling the franchise to Mark Walter’s TWG Global holding company. Purchased for $67.5 million, the Lakers will now sell at a valuation of $10 billion, a record in professional sport. (ESPN)

The NFL has extended its deal with Genius Sports to provide official play-by-play statistics that power the league’s betting and media feeds. (Genius Sports)

English side Crystal Palace, co-owned by American investor John Textor’s Eagle Football Holdings, have been embroiled in a saga relating to UEFA’s multi-club ownership rules. As Textor-owned Lyon are also in next season’s Europa League, Palace are being threatened with a ban from the competition, which does not allow two teams with the same owner to compete. Textor has now sold his shares to New York Jets’ owner Woody Johnson in a deal worth more than £190m. (The Guardian / Bloomberg).

A new, jiu-jitsu league called the Professional Grappling Federation has sold its first team for a reported seven figure amount. The buyer is Kevin Lucas, founder of health platform New Hope Regeneration. (PR Newswire)

The Fenway Sports Group is still looking to build out a multi-club platform in football, and is now eyeing La Liga team Getafe. They were previously rumoured to have been in serious talks with Malaga, Bordeaux and Toulouse. (beIN)

Ares has acquired a stake in the French Sail GP Team, of which Kylian Mbappe is also a co-owner. (Ares)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com