Welcome to another edition of our weekly newsletter on sports investment. It’s been another eventful week, and once again, we have a diverse slate of topics lined up for you. The NBA looks all set to enter the European market soon, alternative football leagues such as the Baller League and Kings League are making waves across the continent, and a new challenger is emerging in professional boxing. All this, and much more awaits you in this edition.

The Sport Investment Studio is an investment and advisory platform dedicated to transactions a the intersection of Sport, Media and Entertainment based in Paris.

FIBA and NBA to explore a new European basketball league.

🏀 What: The NBA and FIBA (basketball’s governing body) have agreed to explore the feasibility of a new, 16-team league in Europe that would involve some of the continent’s most notable sports brands, and could end up rivalling the existing EuroLeague.

🤔 Why, and what would it look like?: The NBA and FIBA have both long held an interest in creating a European equivalent of the former, with the belief being that basketball in Europe has yet to reach its commercial potential. The EuroLeague has also been tapped for a potential merger, but has insofar rejected any such proposal.

NBA Commissioner Adam Silver wishes to build a 16-team league with both existing and new entrants; PSG owners QSI have already reportedly expressed an interest in a new franchise, whereas rumours say that the likes of Real Madrid, Bayern Munich and the Tony Parker led LDLC Asvel could be interested in defecting to the new league.

If it materialises, the league could seriously threaten the EuroLeague, which despite growing interest, would struggle to compete with the financial and commercial might of the NBA.

📰 Read more:

Commissioner Adam Silver’s thoughts on a new European league, and other hot topics in the NBA. (NBA)

An overview on what the league might look like, who might join, and on potential tip off dates. (The Athletic)

A good, short read on the impact this might have on the existing European basketball ecosystem, and in particular, the EuroLeague. (Eurohoops)

Deloitte’s report on women’s sports applauds soaring numbers, calls for long-term value building.

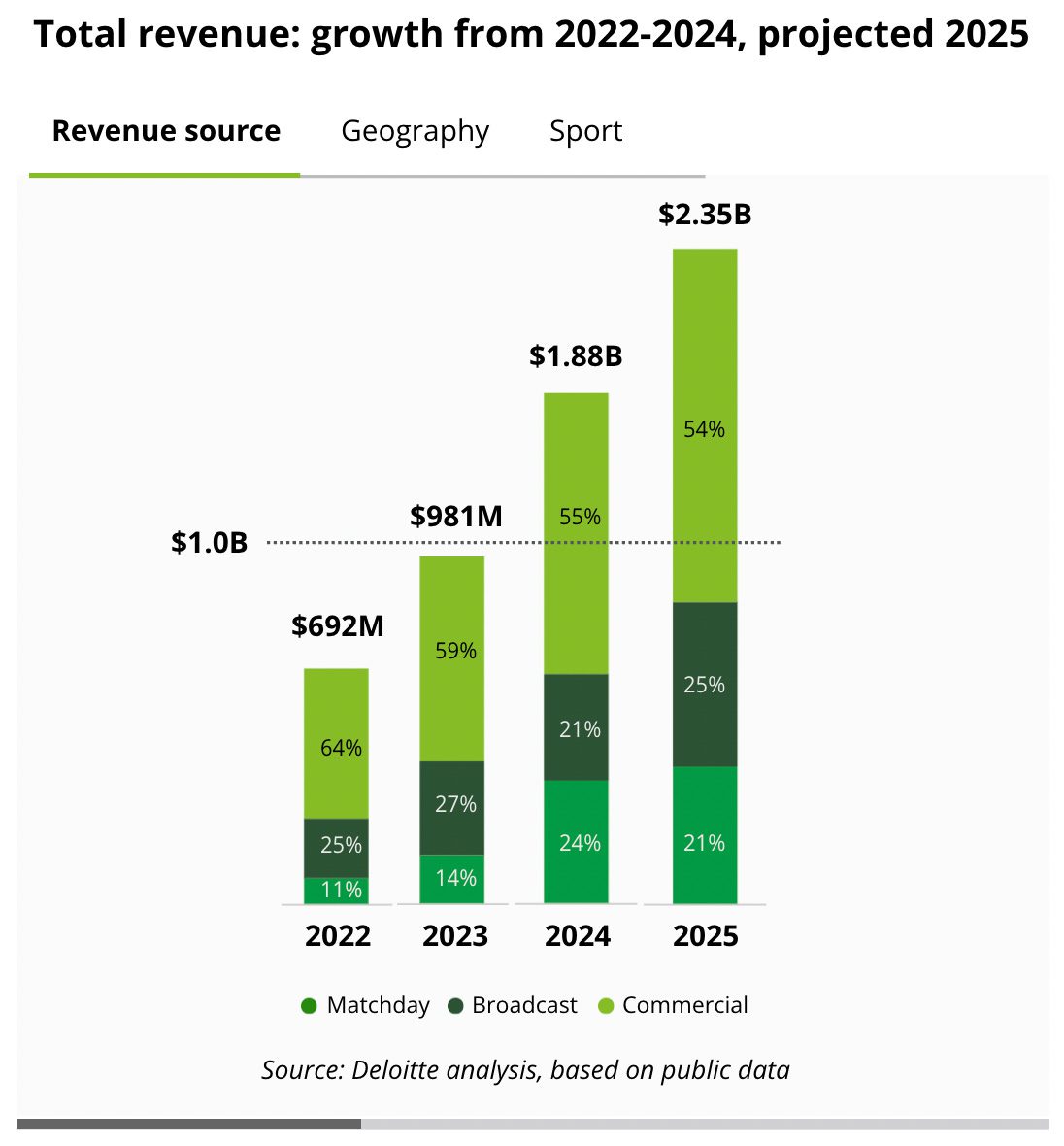

👧 What: A new Deloitte report on women’s sports has highlighted skyrocketing growth, with annual revenues now at over $2.35 billion, nearly thrice of what they were in 2023. North America remains responsible for the majority of this, and for the first time, basketball has overtaken football in revenue generation, largely thanks to the WNBA. The report also provides insights on how the industry can see sustained growth and value-building over the next decade.

🤔 Why, and what’s next: Reasons are both social and economical. For one, pay, access and infrastructure in women’s sport is increasing, thus improving talent pools and inevitably, visibility and investment.

Secondly, commercial potential is finally coming to the fore. Brands as high profile as Louis Vuitton, Dior etc. are realising that there are superstars to be found in women’s sport, and an increasing number of fans in team sports are citing the likes of WNBA star Caitlin Clark, Ballon D’Or winner Aitana Bonmati and Indian cricketer Smriti Mandhana as inspirations. This is leading to more people attending and watching women’s sports events, which in turn increases media coverage, and democratises audiences, as is most notable with the WNBA’s 165% increase in viewership from 2023 to 2024. What is also promising is that these trends are not limited to certain geographies and sports. Women’s volleyball and pickleball leagues are racking up large valuations, Japanese football teams are in the top 20 when it comes to revenue, and the Indian Women’s Premier League is bringing the same level of wealth and fame to women’s cricket as the IPL did to the men’s game 18 years ago.

📰 Read more:

Deloitte’s report. (Deloitte)

An op-ed from Maria Sharapova on the potential women’s sports has from a commercial perspective, particularly for adjacent industries such as fashion and media. (Business of Fashion)

An article highlighting persistent structural and institutional flaws in women’s sport that might prevent it from growing holistically. (The Guardian)

Baller League kicks off in the UK, and Olympique de Marseille partner up with the Kings League.

📺 What: The UK version of the Baller League, an alternative six-a-side football league kicked off last week. The first matchday, which consisted of six games, was broadcast both on Sky Sports UK and YouTube, and racked up over a million cumulative views on the latter. Across the channel in France, Olympique de Marseille announced an official collaboration with Adil Rami’s Kings League team, further adding to the credibility that these new leagues are garnering.

🤔 Why: For one, formats like those of Baller League and Kings League are very digestible, and easy to watch for the casual. However more notably, they involve a laundry list of entertainers, former footballers, and average joes that add a degree of relatability, awe and intrigue to the product. Thus, a bunch of varied audiences congregate in one place to see the likes of John Terry managing a team with ex-Liverpool player Jordon Ibe, while KSI stands on the other end, commanding street footballers and non-league regulars.

In France, Marseille have partnered with ex-player Adil Rami’s Wolf Pack FC, who will take part in the impending French edition of the Kings League. The team will wear Marseille’s blue and white, and we can expect further commercial and brand synergies to develop. The partnership is akin to what Juventus did with Kings League Italy, and points to a world where traditional football is not a competitor, but a partner of the many new alternative formats that are popping up.

Though competitive products (Baller League was founded in Germany and is now expanding to the UK and USA, while Kings League has been more popular in the Mediterranean), both leagues are good test subjects to verify the claim that traditional football is too long and boring to retain audiences. So far, one can argue that their rapid rise is in favour of this claim, but let’s see if they can keep up the hype.

📰 Read more:

More information on Kings League France, and on Marseille’s partnership with Adil Rami’s team (Foot Mercato)

A good primer on the long term viability of alternative competitions like Baller League and Kings League. (SportsPro)

A great interview with Baller League co-founder and CEO Felix Starck. (Business of Sport)

Other pieces of news that interested us:

Spanish second tier side Malaga, owned by Qatari businessman Abdullah Al Thani, are subject to a bidding war from Qatar Sports Investment, and Liverpool owners Fenway Sports Group. Valuations have been quoted to be as high as a hundred million euros, a number that sounds absurd for a team that is 15th in the Segunda Division. (The Athletic / SportBusiness)

STRIKR, a new boxing format that seeks to use live, data-driven scoring in its bouts, has raised $50 million in its initial funding round. STRIKR promises to revolutionise boxing by eliminating often controversial judgement decisions, and replacing them with sensor-based scoring that can track damage as it happens to the boxer. This technology will add new avenues to monetise, particularly for gamblers who can bet on essentially a play by play basis, like in other sports. (Sky Sports)

Notable sport investor David Blitzer is close to sealing a deal to sell his majority stakes in the MLS’ Real Salt Lake, and the NWSL’s Utah Royals, to the Miller family. Blitzer bought RSL for ~$400m three years ago, and soon after purchased the option to revive their NWSL counterparts for around $2 million. Valuations have spiked in both leagues since then, with Sportico pegging their estimations for both franchises to be around $525m, representing a tidy profit for Blitzer. (Sportico)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com