The Sport Investment Studio is an investment and advisory platform dedicated to transactions at the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

Welcome to another edition of our newsletter on sports investment. This week, we talk about how the landscape of sports intermediaries is becoming increasingly consolidated, with the world’s biggest agencies acquiring their smaller counterparts. Private equity interest in the space is also rising, thus creating a situation where certain agencies are financially pulling away from the chasing pack.

I hope this newsletter gives you some useful background, insights and ideas on sports investments trends that we identify and focus on.

Don’t hesitate to reach out to us for more, or to share your comments

What’s going on?

The biggest sports representation agencies are becoming even bigger, and private equity investors are now beginning to flood the industry with capital. Here are some recent examples of this:

Wasserman has been on a spending spree, acquiring agencies in Switzerland (IFM), USA (KO Sports), Belgium (SportPlus), Ireland (Line Up) and the UK (Volante). These have deepened its talent pool further, giving it the rights to represent key athletes in these countries across football, rugby, hockey and a host of Olympic sports. In 2022, Providence Equity had taken a minority stake in Wasserman.

Bruin Capital led a four way merger of agencies in 2024, combining them to create AS1, which now represents nearly 300 footballers worldwide. The enterprise value, at the time of acquisition was $310mn.

CAA Sports acquired Portas Consulting a couple of months ago, thus expanding to include sports consulting services under its umbrella. A leading player in the Middle East, Portas has been instrumental in assisting with the ideas that Saudi Arabia and the UAE have plotted in sport over the past decade. CAA’s case is particularly interesting and concentric. The Pinault family acquired a majority stake in it last year, not long after it had bought ICM, which itself had purchased Stellar Group, a major name in football representation.

Klutch Sports bought Rep 1 Baseball in 2023, before acquiring European football agency ROOF less than six months later.

Velocity Capital injected £100m in Unique Sports Group earlier this year, while Hollywood talent agency Gersh expanded into sports by acquiring Spanish agency You First.

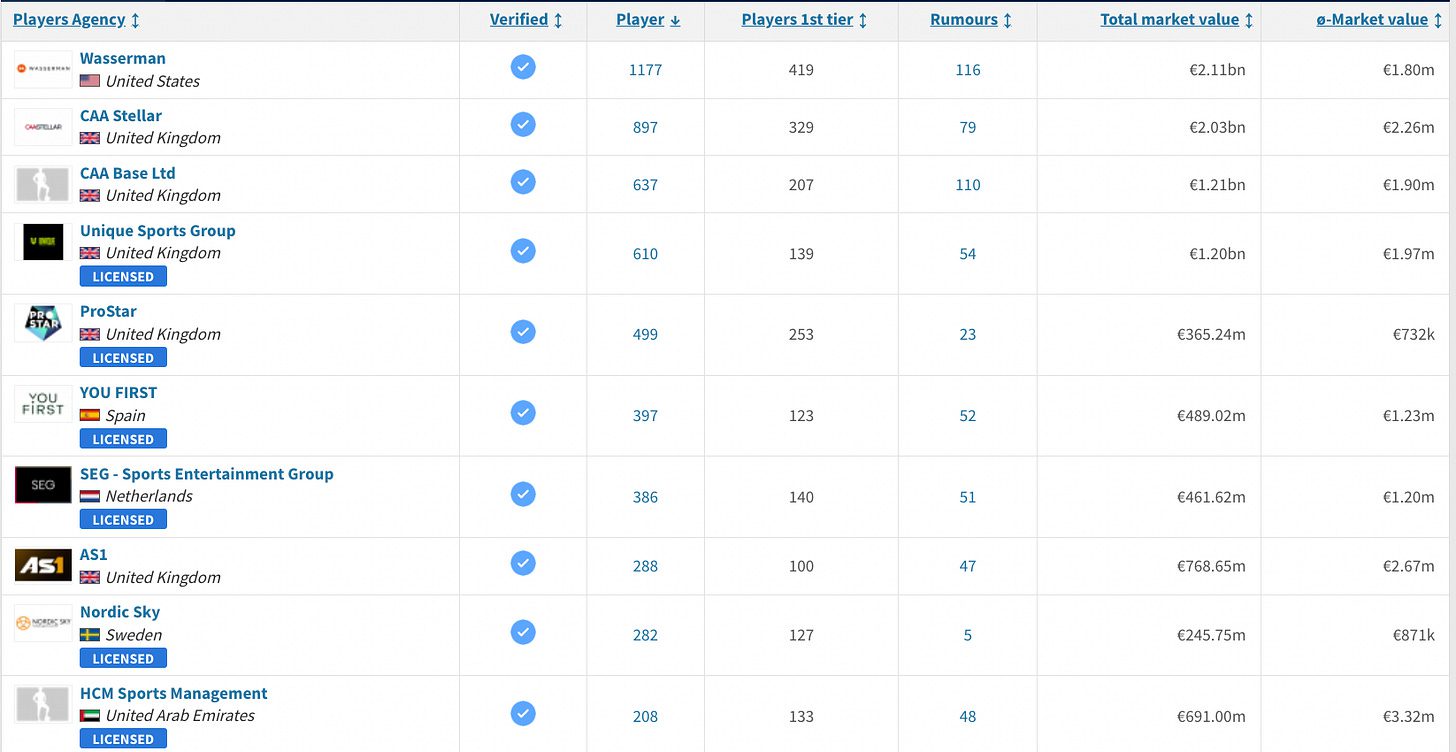

The ten biggest football agencies in the world now manage over 5,000 players, with a combined estimated market value of their players amounting to billions of euros. (Transfermarkt).

Why is this happening?

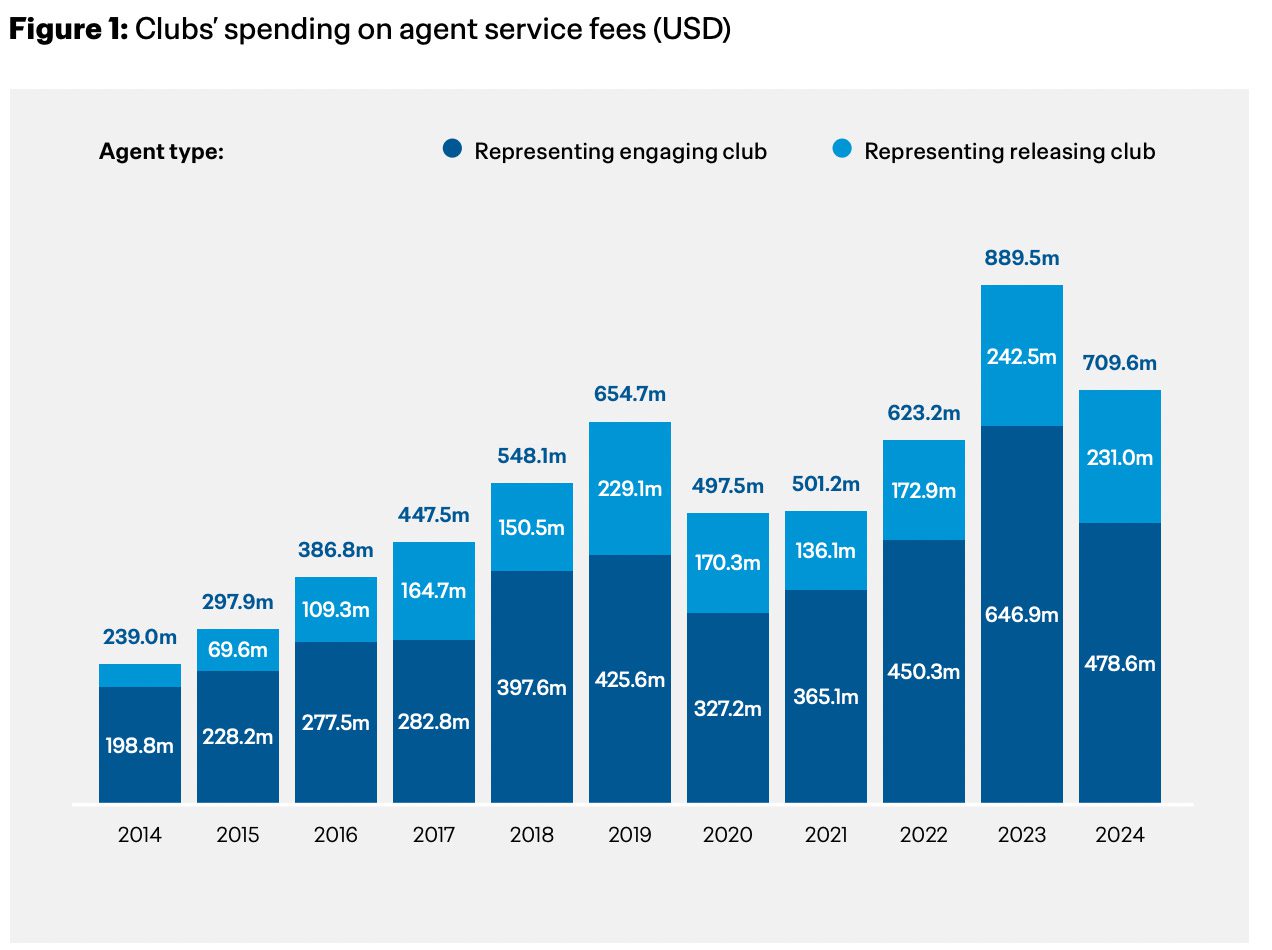

The industry is marked by predictable, stable and high cash flows that come as a result of minimal investment. Even aside from transfer windows, agencies earn commissions on commercial rights and contract renewals, thus making them irreplaceable in modern sport. With agency fees amounting to 7-8% of deal value, and with billions being spent on transfers and contracts every year, private investors are seeing an easy way to make money.

The representation business is now far more professional and diverse than it used to be. With players being exposed to new commercial opportunities (like bespoke documentaries), data-driven contract negotiations and the possibility of becoming investors themselves, the level of service demanded is high. Thus, agencies need to diversify and consolidate their offerings as much as possible.

With more money on the table than ever before, both clubs and players need reliable agents to negotiate a fair deal. FIFA is also cracking down on dodgy agent behaviour, having mandated higher barriers to entry for intermediaries. In such a landscape, large agencies are able to provide greater levels of trust. The size of their apparatus also allows them to spread compliance costs across a wider base, something that smaller setups may not be able to afford.

As new geographies (Middle East for football and motorsport, Europe for American football and basketball, USA for cricket) emerge, agencies need to have a global footprint to meet the needs of rightsholders, players and teams. This explains why CAA is investing in a sports consultancy in the Middle East, and why Wasserman has been aggressively expanding in Europe.

What comes next?

As the market for major sports and leagues becomes concentrated, agencies will begin focusing on emerging domains. Wasserman recently acquired Volante Sports, which is a women’s football agency, and groups like USG and Octagon are expanding their base of talent in cricket, hockey and rugby. As revenues and commercial opportunities in new sports like pickleball and padel increase, we can expect agencies to begin snapping up the finest talents within them.

Exit windows are opening, and at least one super-agency is likely to test public markets. Excel Sports has hired Moelis to canvas buyers at an estimated US $1.6-2 bn valuation, and as a wave of PE exits beckons in the next few years, agencies like CAA and Wasserman may be tempted to go public.

Revenue diversification will accelerate. Agencies are already moving beyond straight contract commissions into venture capital, data and content. Wasserman launched a venture arm to take equity in sports-tech start-ups, and was also appointed as the global sales agent for WTA Ventures, thus becoming a rightsholder in its own capacity. CAA has a similar property, Connect Ventures, which it operates with venture capital firm NEA.

📰 Read more:

The FT’s piece on how big agencies are becoming bigger, with more insight on how private equity is reshaping the representation landscape in professional sport. (Financial Times)

FIFA’s annual report on agent activity in football. (FIFA)

Other pieces of news that interested us:

An interview with the All England Lawn Tennis Club’s CEO, Sally Bolton, on how Wimbledon is trying to stay at the pinnacle of sports entertainment in an ever-saturated landscape. (Financial Times)

Velocity Capital Management has partnered with Elevate and the Texas Permanent School Fund Corporation to launch a $500m fund targeting commercial and infrastructure investments across US college sports. (PE-Insights)

Como 1907 have launched SENT Tourism, a subsidiary that shall package matchday experiences into luxury tourism opportunities. (Como 1907)

FIFA are struggling to sell tickets for the Club World Cup in America, which will have kicked off by the time you’re reading this. (Associated Press)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com