Welcome to another edition of our weekly newsletter on sports investment. This week, we discuss the expansion of the NFL’s Global Markets Program, Chelsea’s controversial accounting move, the impact of US tariffs on sportswear stocks, and much more!

The Sport Investment Studio is an investment and advisory platform dedicated to transactions a the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

NFL expands Global Markets Program, adds four more clubs and two more countries.

🏈 What: The NFL’s Global Markets Program, which grants clubs the rights to pursue marketing activities in other countries, has added two new countries (the UAE and Greece), and four new teams (Baltimore Ravens, Green Bay Packers, LA Chargers and Washington Commanders) to its roster. The league has also confirmed new venues for its international games, with NFL matches now scheduled in Berlin, Madrid, Dublin and Australia as well.

🤔 Why?: The NFL’s international reach continues to grow strongly, and its games outside of America have been quite successful from a commercial point of view. Keeping that in mind, it’s only fair that the league’s teams attempt to expand their international marketing efforts.

Though revenue numbers from international marketing programs are not very high yet, league executives will be hoping that with more markets and teams being gradually added to the GMP, this will begin to change soon. The GMP stipulates that 20% of all revenue over $1 million in a given country has to be shared with the rest of the league from the third year of operations onwards. That is merely a drop in the ocean for an NFL team, so if things don’t change, we might see calls for a policy change.

📰 Read more:

The NFL’s overview of their Global Markets Program and its expansion. (NFL)

The jury is still out on whether the league’s program has been successful, with the Sports Business Journal reporting that revenues remain minimal after three years of its launch. (SBJ)

More on the NFL’s plans to continue playing games abroad, in new locations including Berlin and Dublin. (Forbes)

Chelsea dodge PSR sanctions temporarily by selling women’s team to their parent company for £198.7m.

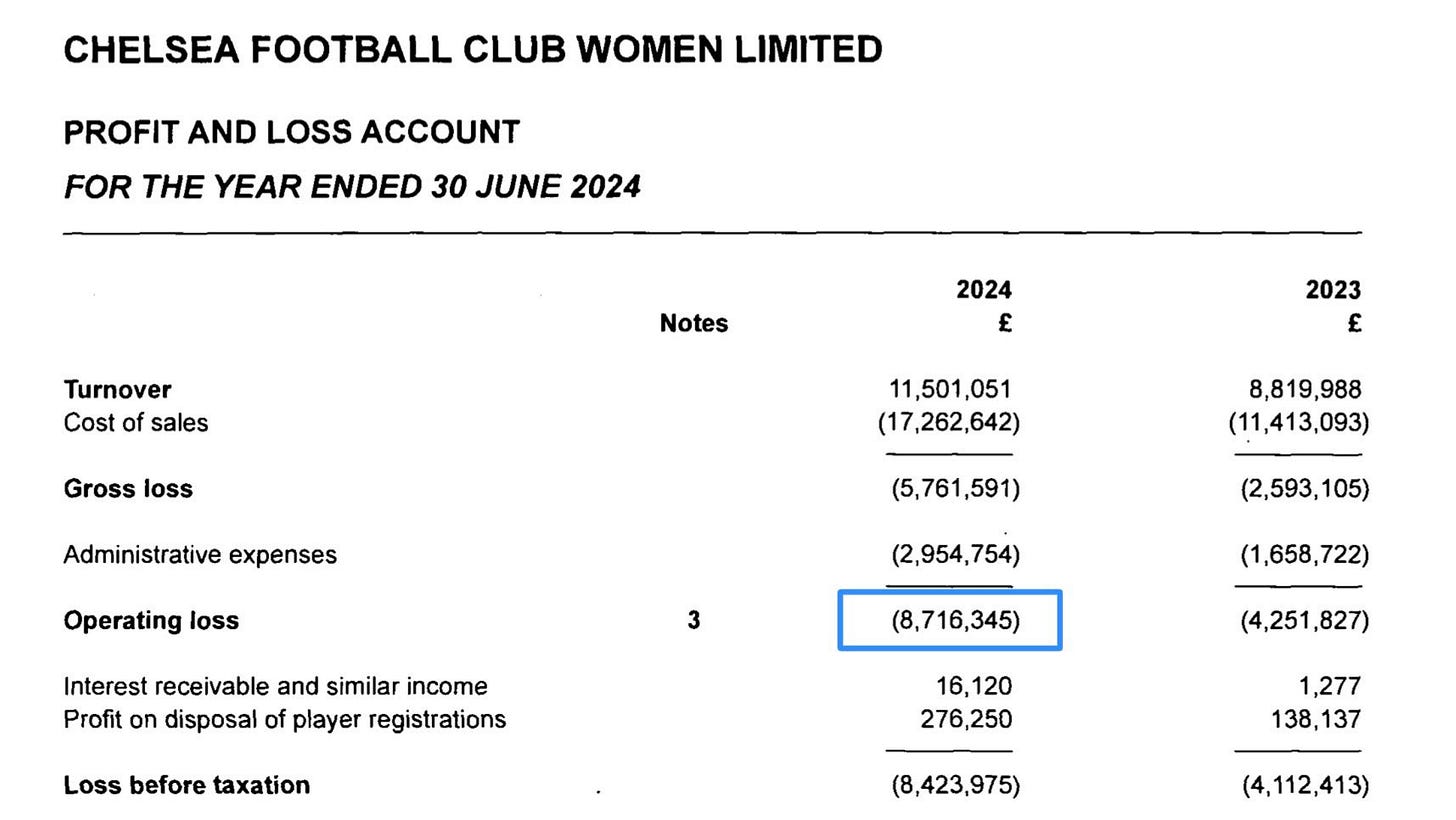

👧 What: Chelsea reported a pre-tax profit of £128m for the 23/24 season, but this was only possible due to a controversial sale of their women’s club to the team’s parent company, BlueCo for around £200m pounds. Such transactions are permitted by the Premier League’s profitability and sustainability rules, but this specific sale has not yet been approved by its fair value controls. UEFA on the other hand, have already refused to include the deal in Chelsea’s accounts, which means that a sanction or exclusion from UEFA competitions is likely for the club due to an FFP breach.

🤔 Why: Clubs have been looking for increasingly creative loopholes within the Premier League’s PSR framework over the past few years, and Chelsea have been among the leaders in this regard since their takeover. Their exorbitant spending in the transfer market has meant that meeting PSR guidelines is nearly impossible using normal means; last year, the club sold some hotels and a car park at a profit of 76 million pounds to help, and this sale is simply an iteration of the same tactic. However, given the fact that Chelsea’s women’s team only makes 11 million pounds a year, operates on a loss and doesn’t have a massive list of valuable assets, a 200 million pound valuation seems overblown.

The Premier League is yet to give its verdict on whether Chelsea’s sale was valid, however if it is found that it wasn’t, points deductions and fines similar to those of Nottingham Forest and Everton might be coming. UEFA are far stricter, and Chelsea’s losses are double what they allow. A settlement with them is being negotiated now, with the possibility of another fine and exclusion from European competitions.

📰 Read more:

An overview on Chelsea’s scheme, and on potential punishments that could await them. (BBC)

Clearly, Chelsea are inspiring their contemporaries. Aston Villa are planning to sell their women’s team for similar gains. (The Times)

Stefan Borson’s reading of Chelsea’s PSR shenanigans, and how they could sound an effective death knell for regulations like it. (Stefan Borson on Substack)

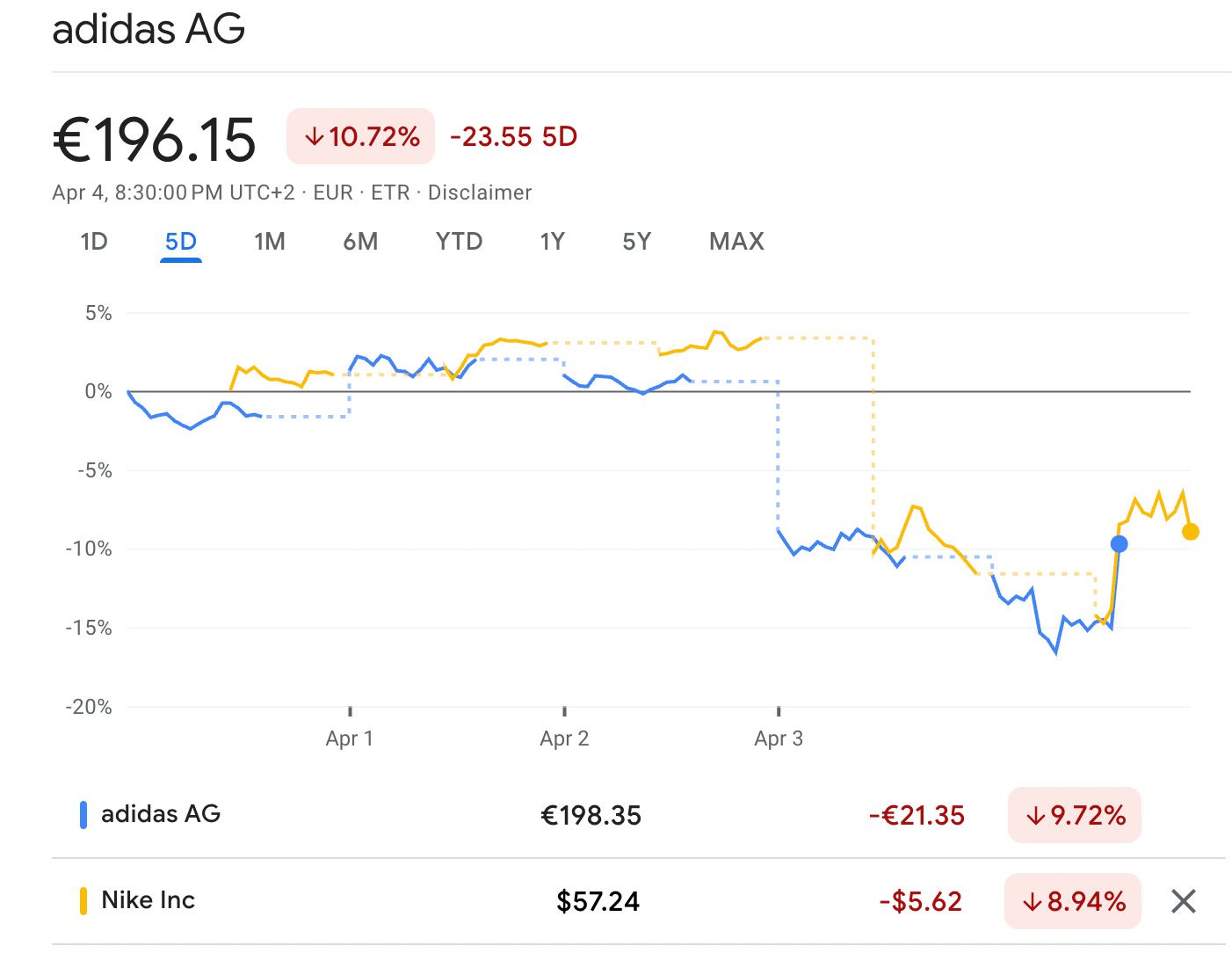

Trump declares tariff ‘Liberation Day’, sportswear stocks sent into a frenzy

📺 What: The Trump administration’s global tariffs have rocked the world economy, wiped out trillions from public markets, and stoked fears of a worldwide recession. Unsurprisingly, sportswear companies that rely on well-integrated, global supply chains are among the big losers.

🤔 Why: A majority of the products that companies like Nike, Puma and Adidas produce are made in Asia, with Vietnam alone representing around 40% of Adidas’ shoe production capacity. Trump has slapped a 46% levy on Vietnam, which would require shoe manufacturers to raise prices by anywhere from 20 to 30% to meet rising costs.

Finding new countries to manufacture in is a lengthy, expensive and risky process, so for now, companies with a large presence in Vietnam are pinning their hopes on an upcoming meeting between Trump and To Lam, the General Secretary of the Communist Party of Vietnam. Talks of reduced tariffs and a possible delay are already abuzz, which would provide some relief.

📰 Read more:

The BBC’s reading of how Trump’s tariffs might impact professional sport. (BBC)

The Financial Times’ report on the impact brands like Nike and Adidas are facing from tariffs. (FT)

ESPN’s investigation into how the industry is preparing to shield against Trump’s devastating tariff announcement. (ESPN)

Other pieces of news that interested us:

Meta and the UFC have signed a large-scale sponsorship deal, months after UFC President and CEO Dana White joined Meta’s board. The deal will see Meta sponsor UFC events, and also integrate its technologies with said events to improve fan engagement. (CNBC)

The Ultimate Tennis Showdown, a new, fast paced tennis format held a tournament at a Roman amphitheatre in Nîmes, which made for some amazing visuals. Founded by French tennis coach and entrepreneur Patrick Mouratoglou, the event attracted 20,000 spectators over two days, thus creating a raucous atmosphere. (Le Figaro)

OliverWyman has come out with a new report/how-to guide for private equity investors wanting to enter sport. It contains lots of nifty data points and a good high level overview on where value can be found for PE investors in sport over the next few years. (OliverWyman)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com