Welcome to another edition of our weekly newsletter on sports investment. This week, we discuss the growing appeal of the Masters and Wimbledon for the super-rich, Mbappe’s legal battle with PSG, a potential investment from Adidas into the Bundesliga, and much more!

The Sport Investment Studio is an investment and advisory platform dedicated to transactions a the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

The Masters Tournament tees off amid ever-expanding interest from luxury buyers.

⛳️ What: The 2025 edition of the Masters Tournament at the Augusta National Golf Club set off in the US last week. The golf club is already seen to be among the world’s most exclusive, and the tournament itself is now further commercialising its appeal to the wealthy.

🤔 Why: Golf has always been a sport for the wealthy, and Donald Trump’s attachment to his golf resort of Mar-a-Lago has taken this narrative to another level. Thus, access to a tournament like the Masters now not only represents another totem of luxury, but a passport to potentially network with the new American elite. Off the back of this, the club’s new hospitality venue is seeing ticket prices as high as $17,000; the existing Berckman’s Place requires a buy-in of around $25,000. Replete with high end food and hospitality offerings, these clubs represent the pinnacle of golf luxury, and more such venues are on the way soon. The effect has also spread to areas around the golf course; short-term rentals in the area are now a mini-industry of their own, and see skyrocketing prices during tournament season.

📰 Read more:

Front Office Sports’ lowdown on the Masters’ expanding luxury appeal, which is leading to soaring revenues. (FOS)

An amusing (and possibly inspiring) story on a local refusing to sell her house, which is adjacent to the Augusta National Golf Club, despite exorbitant offers and pressure. (Yahoo)

Joe Pompliano’s overview (from 2023) on how the Masters has become a $150 million business, great for those that are new to golf. (Joe Pomp Show)

Mbappé’s legal team takes fight to PSG in a bid to recover €55m in bonuses from the club.

🇫🇷 What: Kylian Mbappé’s legal team has filed multiple additional lawsuits to recover €55m in unpaid bonuses, which the player’s camp claims are owed to him. This is the latest chapter in a relationship that has become increasingly acrimonious in the past couple of years.

🤔 Why, and what’s next: The last few years of Mbappe’s spell at PSG were quite tumultuous, with reports of dressing room squabbles, disagreements with the board, and a long-standing contract dispute. The player signed a new two year contract in 2022, supposedly under much pressure from external parties, but chose not to activate the option of extending it for a third year, much to the ire of the club’s fans and board. He then joined Real Madrid for free in 2024, and his relationship with PSG has continued to sour since.

PSG argue that in 2023, when the player decided against signing a new contract, there was a verbal agreement that his loyalty bonus would be relinquished. The money has already been frozen from PSG’s bank accounts according to Mbappe’s legal team.

UEFA have already clarified that the case relates to them only tangentially, and hence they are unlikely to intervene in the matter. Thus, the onus to decide who wins is on the French legal system.

No matter the outcome, one thing is clear: the biggest stories in Ligue 1 always seem to be happening in the courtroom, and not in and around the pitch.

📰 Read more:

An overview on Mbappe’s continuing rift with PSG. (New York Times)

Excerpts from Kylian Mbappe’s first interview since joining Real Madrid, which has sparked more controversy in France. (OneFootball)

The DFL explores the possibility of a €100m cash injection from Adidas.

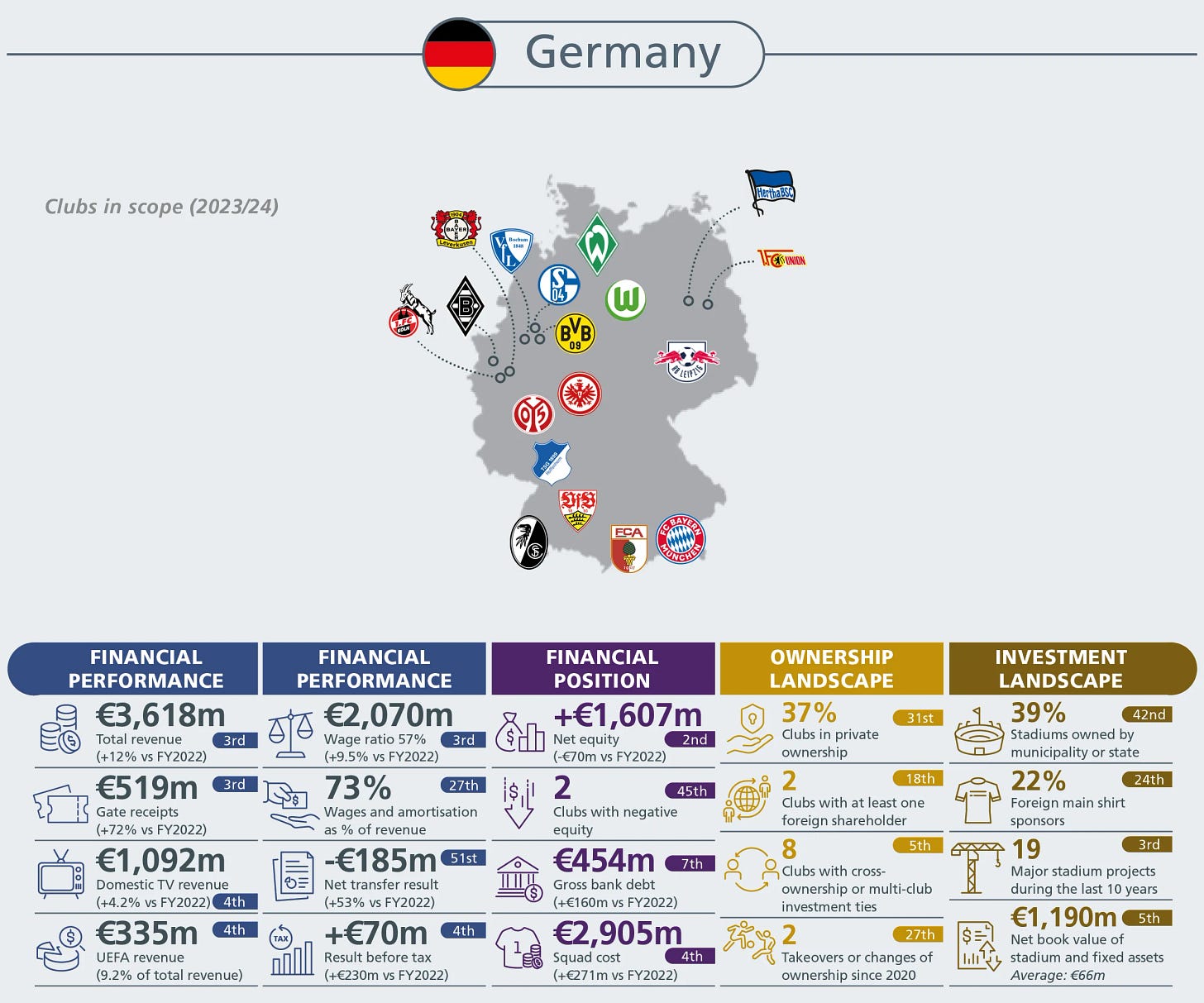

🇩🇪 What: After years of trying to secure external investment into the Bundesliga, the Deutsche Fußball Liga is now reportedly closing in on a €100m deal with longtime partner Adidas.

🤔 Why: The Bundesliga’s competitors in France and Spain have received large cash injections from private equity funds in recent years, but strong anti-corporate fan sentiment has prevented the same from happening in Germany. Though the league remains competitive and financially sustainable, there is a belief among the halls of power that to compete with the Premier League and the might of European giants like Real Madrid and Barcelona, more capital is required.

Compared to foreign funds like CVC, Adidas represents a homegrown and trustworthy alternative, even if the corpus of investment is much smaller than what private equity funds have committed to other leagues. As part of the deal, expanded sponsorship agreements are likely to be on offer, and though part of the investment will have to be repaid, the interest rate is only around 2%. It remains to be seen now whether the deal will actually come into effect, or if it’ll be shunned to the annals of history like other similar proposals in German football.

📰 Read more:

A primer on how the deal could look. (Sports Business)

A timeline on the DFL’s failed attempts to source private investment into the Bundesliga. (Theo Ajadi)

Other pieces of news that interested us:

Paris Saint-Germain have become the first football club to launch an accelerator at Station F, the world’s largest startup campus. The club are now looking for startups to onboard in three key fields: fan experience, stadiums & training facilities, and health & performance. Across the pond, Utah Jazz owner Ryan Smith has launched a $1 billion fund for startups in sport-tech and entertainment. Ryan Sweeny, partner at Accel, will also be part of the fund. (GlobalData /Station F)

The City Football Group and the Oak View Group have launched a joint-venture that will provide operations and venue management services. The company will begin by providing catering services at the Etihad Stadium and the Co-op Live arena, and shall stabilise employment for around 3,000 people. (City Football Group)

PwC have released their annual report on the evolution of the sports industry in the Middle East, where they have a sizeable practice. The report looks at how infrastructure upgrades, continued government investments and increased media attention are fuelling the region’s dreams to become the centre of world sport. (PwC)

The Wimbledon’s Number One Court debentures, which guarantee best-in-house hospitality and seating at the tournament from 2027-31, now cost a whopping 73,000 pounds. The debentures are tradeable assets, and are issued by the All England Lawn Tennis Club to fund infrastructure upgrades to their facilities.

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com