Welcome to another edition of our weekly newsletter on sports investment. This week, we talk about an impending new wave of private equity investment in sport, a potential upheaval in English rugby, the role of sport in Netflix’s recent successes, and much more!

The Sport Investment Studio is an investment and advisory platform dedicated to transactions a the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

A new wave of private equity interest in sport beckons.

💰 What: American private equity firms are gearing up for a big wave of investment in sport, with the likes of General Atlantic, Arctos, RedBird and more signalling confidence in the industry.

🤔 Why: Sport, as an uncorrelated asset class, has proven to be a safe and fruitful investment. As the battle for attention and audiences gets fiercer, a perfect storm for a new wave of private equity investment is brewing, in leagues, real estate, talent management agencies, teams etc.

📰 Read more:

More on the continually rising interest that private equity firms are taking in sports properties. (Bloomberg / Profluence)

Key private equity players in the US have long been preparing to inject money into college sports, with RedBird Capital Partners leading the race to get the ball rolling. (Dallas Magazine)

Veteran sports investor David Checketts has joined forces with the Eccles family to launch a $1.2 billion private-equity fund focussed on sport investments. (Sportico)

Netflix remains strong despite market headwinds, performance helped by sports properties.

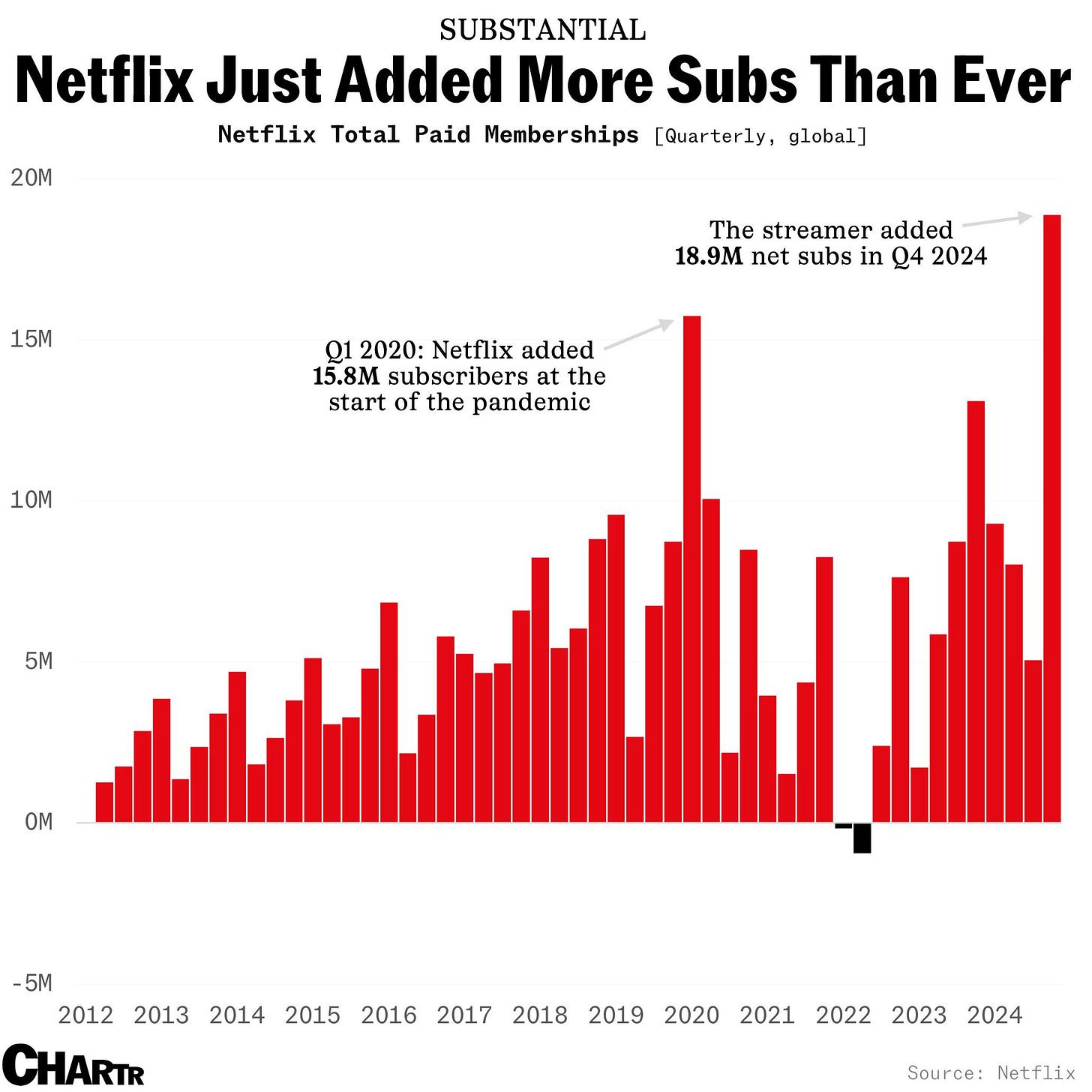

📺 What: Despite major fluctuations and slides in public markets, Netflix has stayed strong and is up 24% in the year-to-date,helped by successful investments in sports rights.

🤔 How, and why?: The celebrity boxing fight between Jake Paul and Mike Tyson, the WWE, as well as the addition of NFL games to the platform have unlocked new audiences for Netflix. Given that sport properties by nature (at least the established ones) provide a degree of excitement, a pre-existing brand image and a solid proof of concept, investments in media rights can prove to be safer than pouring money into new movies and TV shows especially in uncertain economic times. Sports audiences have also proven to be recession/uncertainty proof, and this is what is driving interest to it, whether from private equity funds (as we saw above) or from media majors.

With the streaming landscape becoming as scattered and expensive as traditional cable television, major players are all lining up to create a one-stop shop that provides the most value for money. Sport is part of this strategy, and Apple’s play with the MLS is a key example, even if it has not panned out as expected. If Netflix can keep picking up high-profile sports rights and package them attractively, it may find far more success.

📰 Read more:

FOS’ report on Netflix’s recent market successes (Front Office Sports)

Netflix added more subscribers last quarter than in any other previous quarter, and it seems as if their investments in WWE and influencer boxing did indeed play a large role in this. (Insider Sport)

More on Netflix’s newfound and ambitious approach to sport. (Financial Times)

English rugby looks to Indian cricket for inspiration as it plots a major revamp.

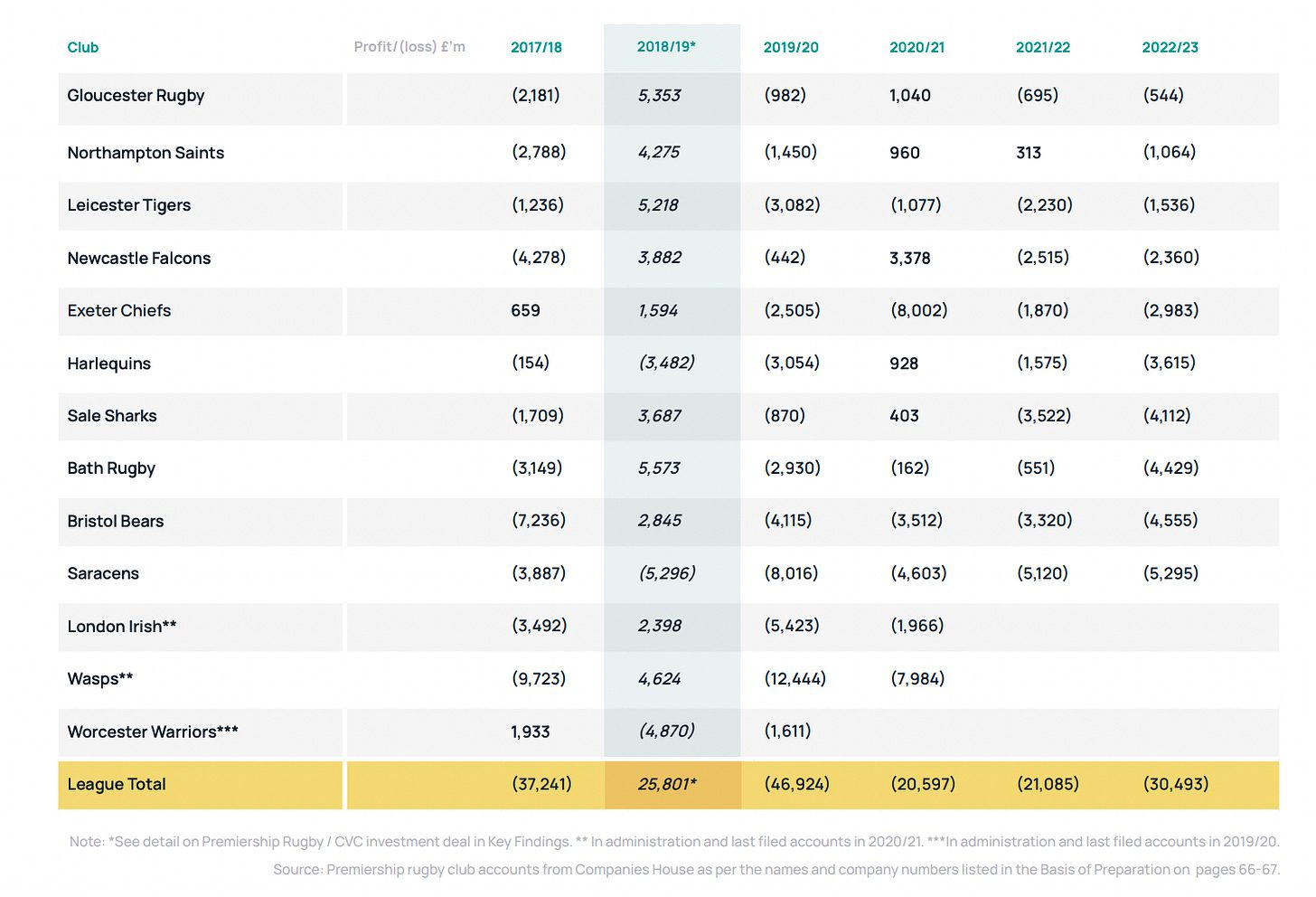

🏉 What: To revive itself, England’s Premiership Rugby league is looking east to the Indian Premier League for inspiration. By looking to create a closed-shop league led by a franchise model and new expansion teams, it wants to save a sport that is currently deeply endangered in its home market.

🤔 Why: Rugby in England is in a crisis. The national team is struggling, players aren’t being paid on time, power struggles persist among club leaders and union board members, losses are rife, and the grassroots game is dying. Talks of a revamp are also not new by any means. Over the past decade, such transformations of the sport have been planned numerous times, but each iteration has either failed to materialise, or failed to soothe the crises that plague it.

An IPL inspired transformation seems to be the new trend in English sport; the Hundred (a cricket league in England) is also opening itself up to foreign investment in order to revive grassroots cricket in England while remaining commercially competitive with Asia. However, the IPL’s model is neither easy to replicate, nor is it a guaranteed path to success. The reason it is so successful in India is that cricket enjoys a religion-like craze in the country, and this is compounded by the obsessive levels of popularity cricketers and celebrities are subject to. There is no doubt that it is a great media product, but unless one can create similar levels of stardom and have a scale similar to that of India, its model cannot be copy-pasted to other sports. In countries like England where rugby/cricket aren’t the premier sport, and populations are smaller, such commercialisation may not lead to similar results.

📰 Read more:

More on how exactly Premier Rugby is planning to model itself around the IPL. (Financial Times)

A video interview with Bill Sweeney, the CEO of the Rugby Football Union, wherein he delves into the problems facing the sport in England. (Business of Sport)

The league has already been planning large investments in content creation and distribution, alongside the possibility of hosting matches abroad. (SportsPro)

Other pieces of news that interested us:

Jason Kidd, Head Coach of NBA franchise Dallas Mavericks, has joined Everton FC’s ownership group. Some 1,500 miles east, French striker Moussa Dembele has acquired Lithuanian club FK Minja. These two deals only go to further prove that the next big set of investors in sport are players and coaches themselves. (Everton / L’Equipe)

A new whitepaper by the Royal Bank of Canada sheds light on how sports-anchored mixed use districts are driving major value for team owners. With IRRs ranging from 9 to 27% in the US, sport-led real estate developments provide a safe source of returns that are largely unanchored from on-pitch results and team performance. (Royal Bank of Canada / Klutch Sports Group)

Monogram Capital Partners have acquired a majority stake in sports surface-management company Vasco, amid rising interest in tertiary businesses and facility/service providers that support sport. (PR Newswire)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com