The Sport Investment Studio is an investment and advisory platform dedicated to transactions a the intersection of Sport, Media and Entertainment based in Paris. Visit us for more information www.sportinvestmentstudio.com

Welcome to another edition of our newsletter on sports investment. This week, we talk about how stadiums are quickly becoming mixed-use anchors for property development, thus deepening the synergy between the sports business and real estate.

I hope this newsletter gives you some useful background, insights and ideas on sports investments trends that we identify and focus on.

Don’t hesitate to reach out to us for more, or to share your comments

Sports has been in the media business for a long time; it’s now time for real estate.

Sports teams, their owners and both public/private investors are pouring billions into (re)developing stadiums, with a view of making them always-open, mixed-use destinations that draw in large communities.

In Europe, the two most commonly cited examples of this phenomenon over the past few years have been i) Tottenham Hotspurs’ billion pound new stadium, and ii) the new, renovated Santiago Bernabeu, which is now a state-of-the-art venue capable of hosting the most notable concerts in the world.

The goal of such a redevelopment is twofold. For one, large new stadiums fetch additional revenue from fans, commercial vendors that operate on their grounds, and from sponsors that want to associate themselves with the stadium’s custodians. Secondly, they allow teams to create entirely new sources of revenue. By hosting events like concerts and NFL games, and by incorporating hotels, museums, and retailers on their grounds, stadiums bring in money that does not have to be shared with their contemporaries.

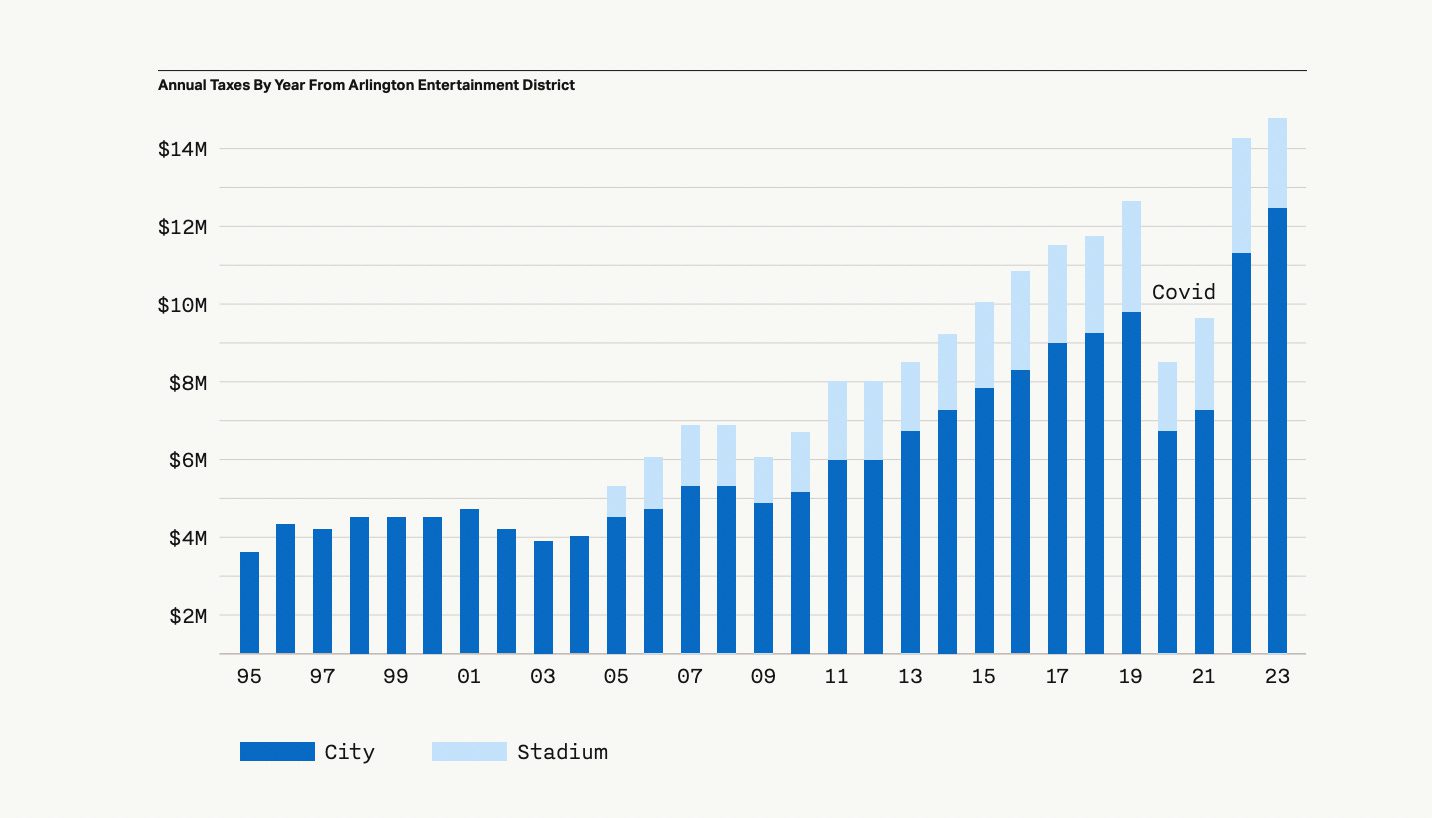

When a stadium draws tens of thousands of people on a regular basis, it doubles up as a venue of both immense economic and cultural significance. According to sports-led real estate developer Seregh, malls have been replaced by stadiums as the primary point of community congregation in the United States. Cities then turn to stadiums and sports-led developments for economic growth, thus creating opportunities for developers to build communities, houses and commercial spaces around these stadiums.

According to Seregh, as well as a whitepaper by the Klutch Sports Group and the Royal Bank of Canada, around 35 stadium redevelopment projects are being plotted in North America, and a further 40 leases are due to expire by 2039. Approximately $100 billion in investment is expected in this domain over the next 15 years, with a decent portion of it being government funding. Backed by Harris Blitzer Sports & Entertainment (HBSE), Creative Artists Agency (CAA), LionTree and other large players, Seregh is looking to capitalise on this investment by offering to develop commercial and residential land around stadiums.

Europe is no slouch in this regard either. Many of the biggest sporting brands on the continent, including Real Madrid, Manchester United, Manchester City, the Milan giants and FC Barcelona are either planning or undertaking large stadium overhauls. Challengers like Leeds United, Birmingham City and on smaller scales, the likes of Como 1907 in Italy are all doing the same. More often than not, when football clubs in Europe are taken over, their ownership groups now lay out plans for some sort of real estate redevelopment.

Again, the concept is not new. For decades, stadiums have been heralded as silver bullets for community regeneration and economic growth: see any Olympic games cycle, the SoFi Stadium in Los Angeles, the Barclays Center in New York, or Michael Bloomberg’s failed plot to build a sports park in the same city, which dates back to 2002. However, there are some reasons that are driving a renewed cycle of growth and hype at the moment:

The commercialisation of sport, which requires greater revenues, always-on cycles and diversification.

Team/stadium owners’ desires to increase the returns they extract from their investments in sport, which is especially pertinent for private equity owners.

A boom in luxury-spending in sport, which is driving appetite for more lucrative and luxuriant experiences.

Economic anxiety and the downfall of commercial spaces like malls as community centres. Sports has not yet been digitalised, which makes it a safe bet for those betting on regeneration.

More interestingly, as Binyamin Applebaum argues in the NYT, stadiums are being built because zoning regulations in America are too strict to build anything else efficiently. Hence, they serve as omnibuses that bring with them much needed commercial and residential developments.

All is not rosy though, as many countries and local governments are pushing back against excessive government spending on stadium projects. Manchester Mayor Andy Burnham for example, made it clear that the city would not spend money on Manchester United’s planned new stadium, seeing it as a luxury expense. The US remains comparatively optimistic on such matters, but increasingly, large sports related projects may have to rely on more creative ways of financing, especially if the political climate of austerity continues across Europe and America.

In countries like France, Spain and Italy, private equity investments into major sports leagues could also help bring in this financing. We previously covered how much of the money injected by CVC Capital Partners into the Ligue 1 was spent on agent fees and transfers. If invested well, this capital could transform the infrastructure that underpins football in France, thus also leading to community regeneration.

📰 Read more:

A good primer on how European sports stadiums, particularly on the top end of the pyramid are beginning to mirror their American counterparts by becoming 24/7, mixed-use developments. (Financial Times)

Arctos’ blog post on how regular renovations of venues help sports properties extract more value consistently. (Arctos on Linkedin)

The English perspective: The hope that sports real estate projects bring to urban communities in desperate need of regeneration. (Financial Times)

The American perspective: How arcane American urban planning processes have led to a situation where sports stadiums are the only thing that the country can feasibly build. Zoning laws and bottlenecks are such that redevelopment projects need to be under the guise of a sports stadium to be ratified. (The New York Times)

A great overview on how NFL stadiums have evolved to become money making machines:

Other pieces of news that interested us:

Platforms like Twitch and YouTube are driving growth towards short form sports tournaments, like the Baller League and Kings League in football. Not only do these successes make us think further about the potential new competitions have, they also signal that for legacy sport, finding accessible, digital-first broadcast deals is key to survive. (Financial Times)

Real Madrid have been valued at $7.1 billion, far higher than any other football club. (Bloomberg)

Disney+ has acquired the rights to stream the UEFA Women’s Champions League across Europe; the deal includes the production of matches, as well as dedicated pre/post shows around the competition. This deal comes at a buoyant time for women’s sport; a few days ago, the WNBA’s New York Liberty raised capital at a valuation of $450 million. (The Athletic / Deadline)

Reliance and Star’s JioHotstar now has 280 million subscribers in India, putting it just 20 million behind Netflix’s global reach. This is largely in part to it having the rights to broadcast the IPL, India’s premier cricket league. Keep in mind that up until a few years ago, Star had the rights to the league, and the transfer of rights to Reliance’s Jio platform essentially forced Disney/Star to merge with Reliance in the country because of how devastating the user loss was. (Financial Times)

That’s all for this week! For more content, follow us on LinkedIn, and if you’re interested in learning more about us, please visit www.sportinvestmentstudio.com